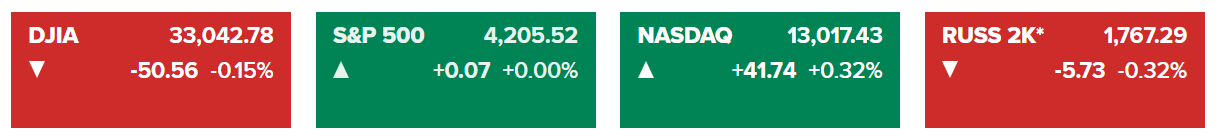

Asian markets looking to open lower after mixed US session

31 May 2023Major US indices finished mixed in the US Tuesday session with AI-mania propping up the Nasdaq to a green finish while continuing debt ceiling jitters kept risk appetite muted for the broader market.

Continuing Ai mania saw Nvidia (NVDA) briefly crossed into the $1 trillion market cap club before pulling back later in the session, still up 3% for the day though and providing a tailwind for the Nasdaq which was the only index managing to make any real gains.

Debt ceiling optimism has faded somewhat since the gap up on Monday after news of a tentative agreement was reached on the weekend. Actually passing the deal through Congress has yet to be done and grumblings of some in congress has markets a little nervous that it might not be as smooth sailing as first thought.

FX Markets

USD was lower on Tuesday in a choppy session, lower yields and risk switching from positive to negative saw the US dollar index chop around, falling below 104 before reclaiming that psychological level after finding support at Fridays lows.

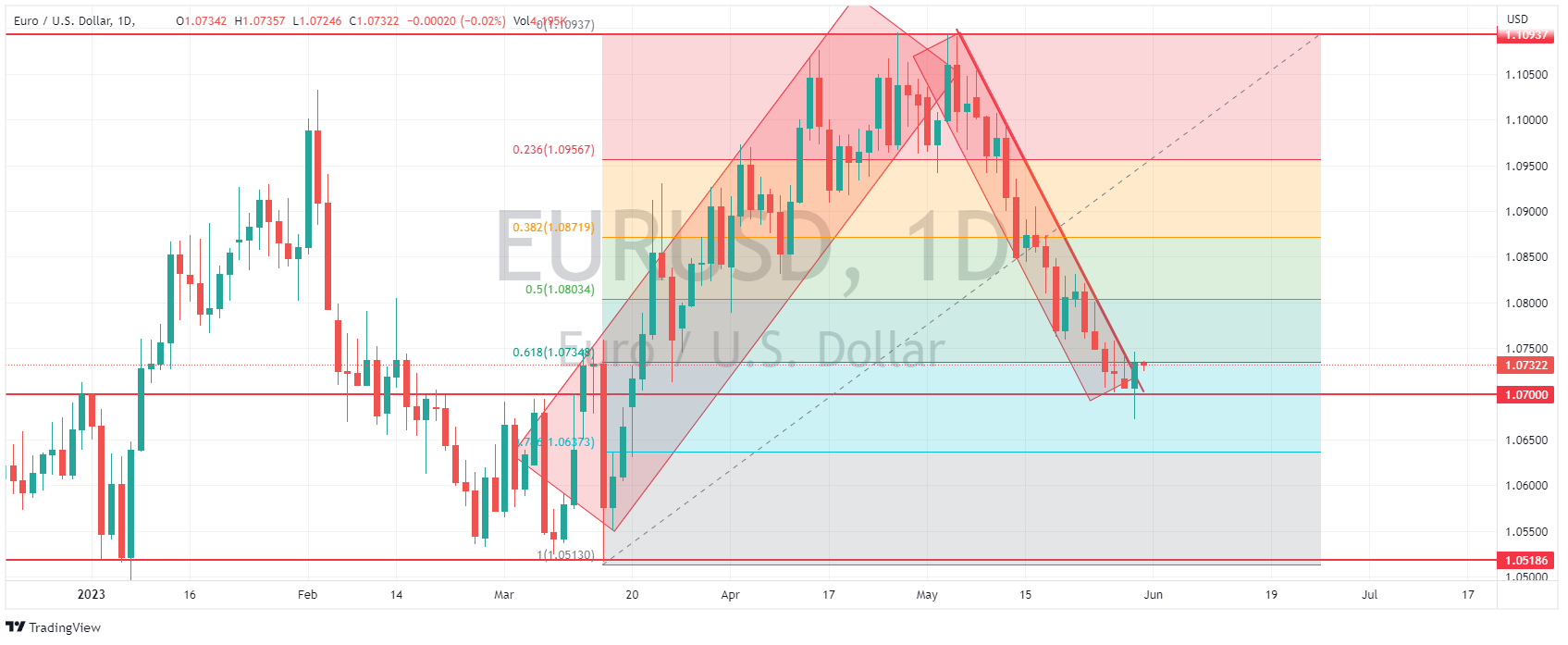

EUR saw gains seeing EURUSD back above 1.07, breaking above its recent down channel level. There is a busy day in the European economic calendar, including German CPI which could make things interesting for Euro traders in Wednesdays session. Technicians will be watching the major support at 1.07 and whether EURUSD can hold above the trend line to gauge whether a push higher looks likely.

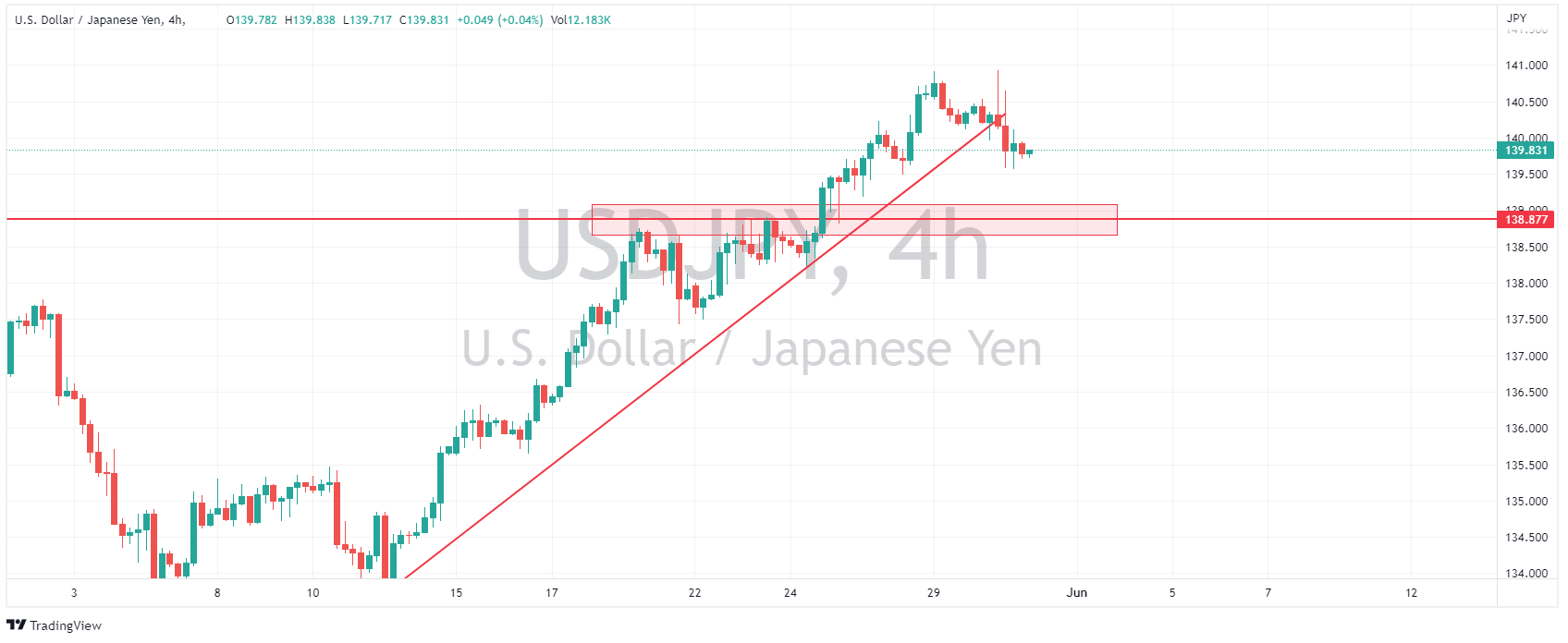

The Yen saw notable strength with USDJPY hitting a low of 139.58 and managing to hold beneath 140 throughout the US session. The Yen supported by the drop in US Bond yields and Japanese MoF commentary that saw remarks on FX intervention if the Yen falls too much spooked Yen shorts.

Commodities

Gold rallied strongly after a dip in the Asian session saw XAUUSD test its major support at 1935 before rebounding strongly to break above resistance at 1950 and hold. Lower yields and debt ceiling jitters providing a tailwind.

Crude oil saw pronounced weakness on Tuesday on concerns about whether the US Congress will pass the debt ceiling bill accompanied by mixed OPEC+ supply messages. USOUSD tumbled through its lower trend line and psychological 70 level to settle at around 69.40.

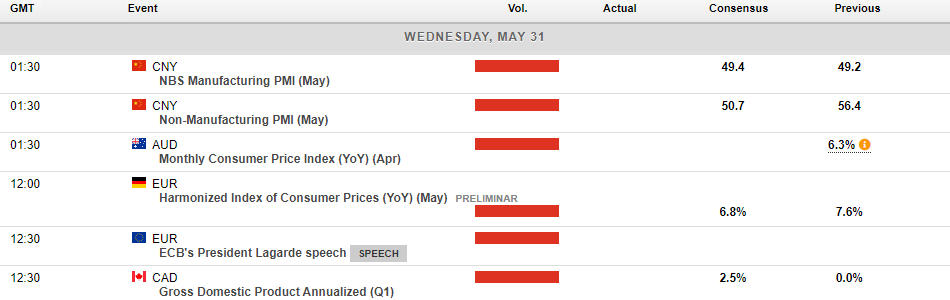

In todays scheduled economic announcements, Australian Cpi at 11:30 AEST will be one to watch for AUD traders, a slight increase in expected from last month’s reading and with AUDUSD hovering just above key support and a market pricing in almost no chance of a RBA hike next week any surprises here could see some real volatility in the AUD.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Hot CPI fails to hold AUDUSD above key level

Australian CPI released today surprised to the upside coming in at 6.8% y/y , well above the consensus of 6.4% which itself was an increase on March’s figure of 6.3% Coming into the figure futures markets had priced in a measly 2.5% chance of a hike next week by the RBA, that changed dramatically with odds jumping to 18.8% for a 25bp hike ac...

Previous Article

Market Analysis 29 May – 02 June 2023

XAUUSD Analysis 29 May – 02 June 2023 Forecasting the price of gold in the short term, the price may move down to test the 1915 support a...