The Week ahead – Debt ceiling deal, NFP and Aussie CPI – charts to watch

29 May 2023News over the weekend of a tentative debt ceiling deal had been achieved should see investors in the week ahead return to their usual programming of trying to predict the next move from the Federal Reserve, which this week’s jobs data will be a critical component.

Late Saturday, the White House and Republican negotiators announced a debt ceiling deal “in principle” set to last two years with a vote on Wednesday in the House to finalise it, all going to plan , we should see the overhang from this fade this week (until next time anyway) and focus turn back to this weeks scheduled data.

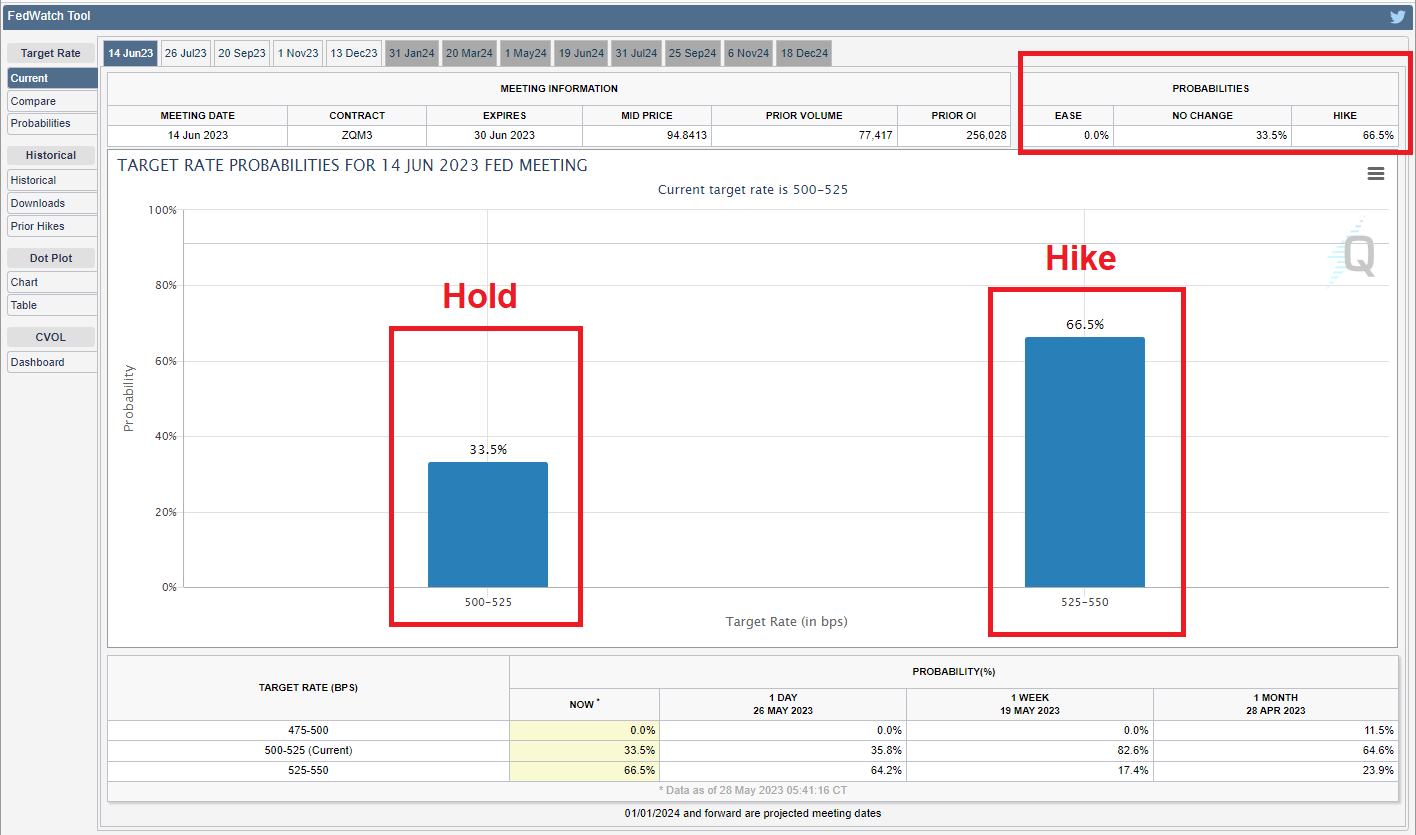

US – Hike odds climbing

Interest rate expectations have shifted decidedly hawkish since the last Fed meeting on May 3rd. The market interpreted the Fed statement as signaling that there was a high hurdle to getting any further rate hikes. However, since then, strong job numbers, sticky inflation and a raft of hawkish Fed speak have seen hike odds jump to 66.5%. This weeks NFP figure on Friday will go a long way to shoring up those odds and will be one to watch for FX traders looking for volatility.

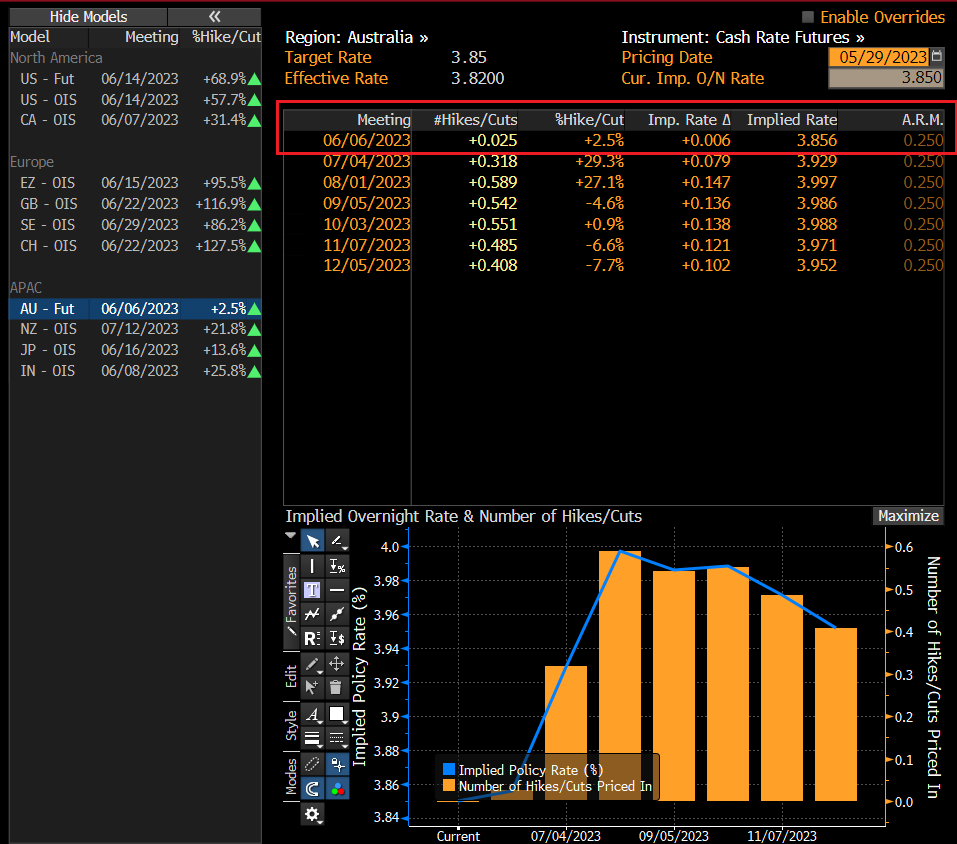

Australia – Inflation looking sticky

Australia’s April inflation is forecast to increase from the previous month. The headline Year on year figure expected to come in at 6.4%, up from 6.3% in March. With inflation remaining stubborn and far outside the RBA’s target range it certainly is creating a headache for the Reserve Bank of Australia. This could be an interesting one, futures markets are pricing in only a 2.5% chance of a hike from the RBA next week, with such a one-sided trade, a big figure here would put the heat on the RBA and possibly see some significant re-pricing of those odds with the accompanying volatility in the AUD.

Charts to watch this week:

Nasdaq 100 (NDX100)

Tech stocks have been on a tear lately, with an AI inspired boom seeing names like Nvidia (NVDA) rise to all time highs. With a debt ceiling deal now seemingly done and AI optimism still firmly in investors minds, the Nasdaq is looking to outperform again this week.

A strong break of the 13720 resistance see’s the next level to test at 15270 with 13270 now possibly acting as support.

AUDUSD

The Aussie has had a horror run lately, breaking down through support after support level to hit 2023 lows in the last week. AUDUSD has found some good support though at the big figure major level of 0.6500, also a lot of this weakness was driven by USD strength as risk off dominated the market during the debt ceiling impasse.

With a debt ceiling deal done and high inflation figures expected out of Australia this week, we could be setting up for a bounce here if the market risk sentiment stays positive.

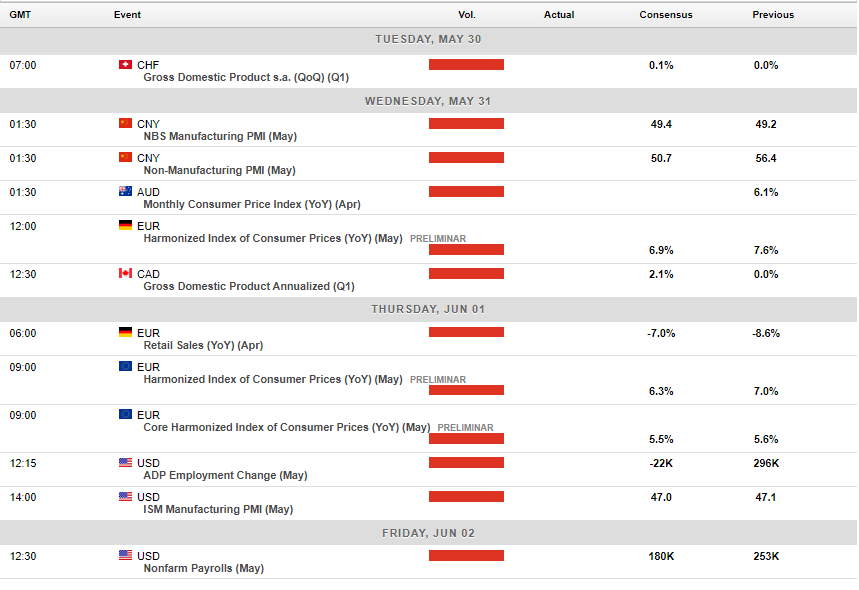

Full calendar of this week’s major announcements below:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Market Analysis 29 May – 02 June 2023

XAUUSD Analysis 29 May – 02 June 2023 Forecasting the price of gold in the short term, the price may move down to test the 1915 support area, which is the area where the price is expected to bounce back. and if the price can stand without falling further Price may have a sideways correction before rallying to test the 1960 resistance a...

Previous Article

US stocks finished mixed – Nasdaq surges on NVDA earnings boost – Gold down again

US indices finished mixed in Thursdays session two up, two down though with an overall positive bias on debt ceiling progress and strong economic data...