US stocks rise to start the new month on debt ceiling optimism, data and Fed speak – NFP ahead

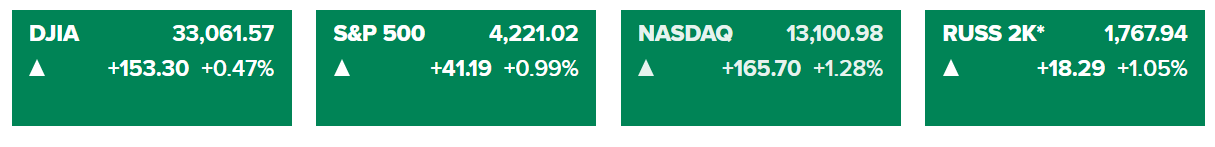

2 June 2023Major US indices broadly rallied in Thursdays session as the US debt ceiling can got kicked another two years down the road after a deal was passed through Congress, US data and Fed speak also supported a narrative shift in expectations of how hawkish the Fed is going to be going forward.

The Nasdaq again led gains, (+165 points / 1.28%) , The Nasdaq is now on pace for its longest weekly win streak since 2020, with AI mania driving the tech sector to outperformance.

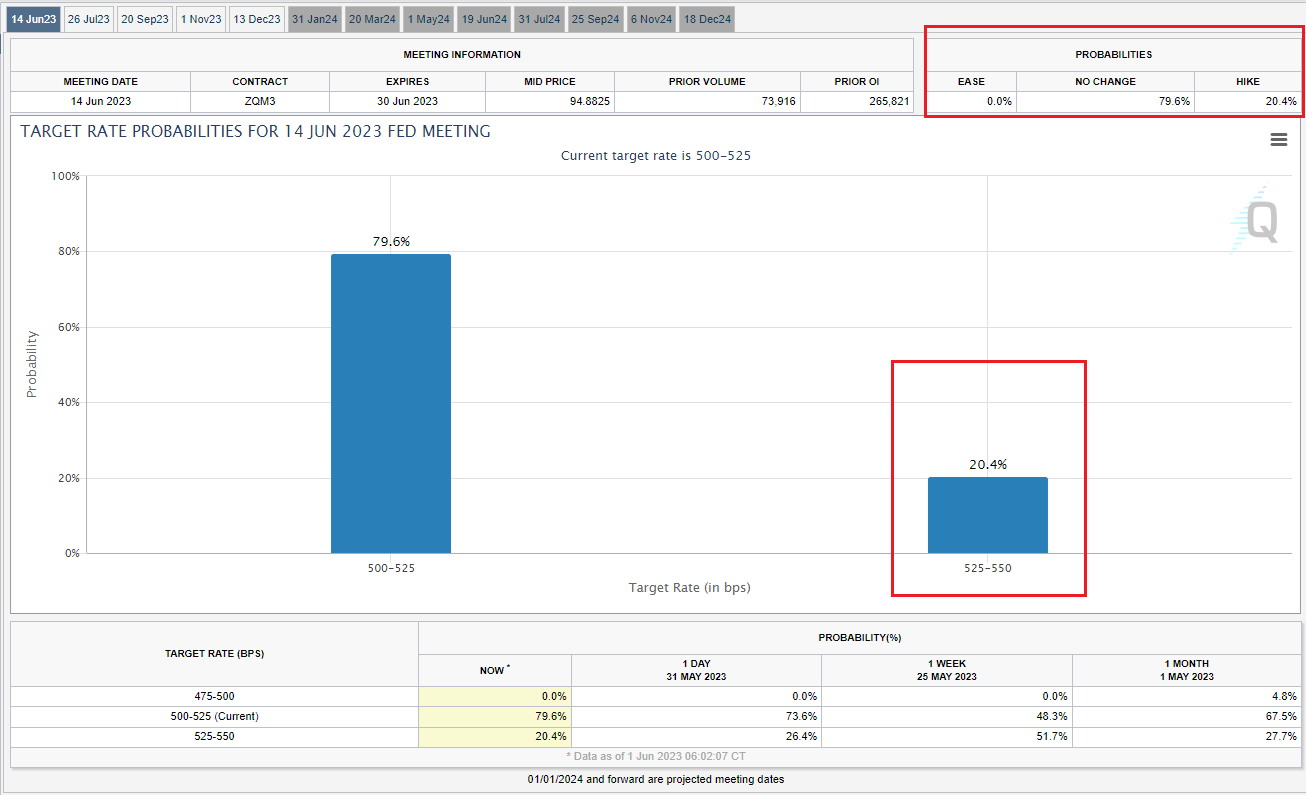

Fed Speak continued to push the idea of a hold of rates in June with the Fed’s Harker saying “I do believe that we are close to the point where we can hold rates in place and let monetary policy do its work to bring inflation back to the target in a timely manner”. Mixed data showing a slow in wage growth and a deterioration in manufacturing saw odds of a hike at the next FOMC meeting drop to 20%.

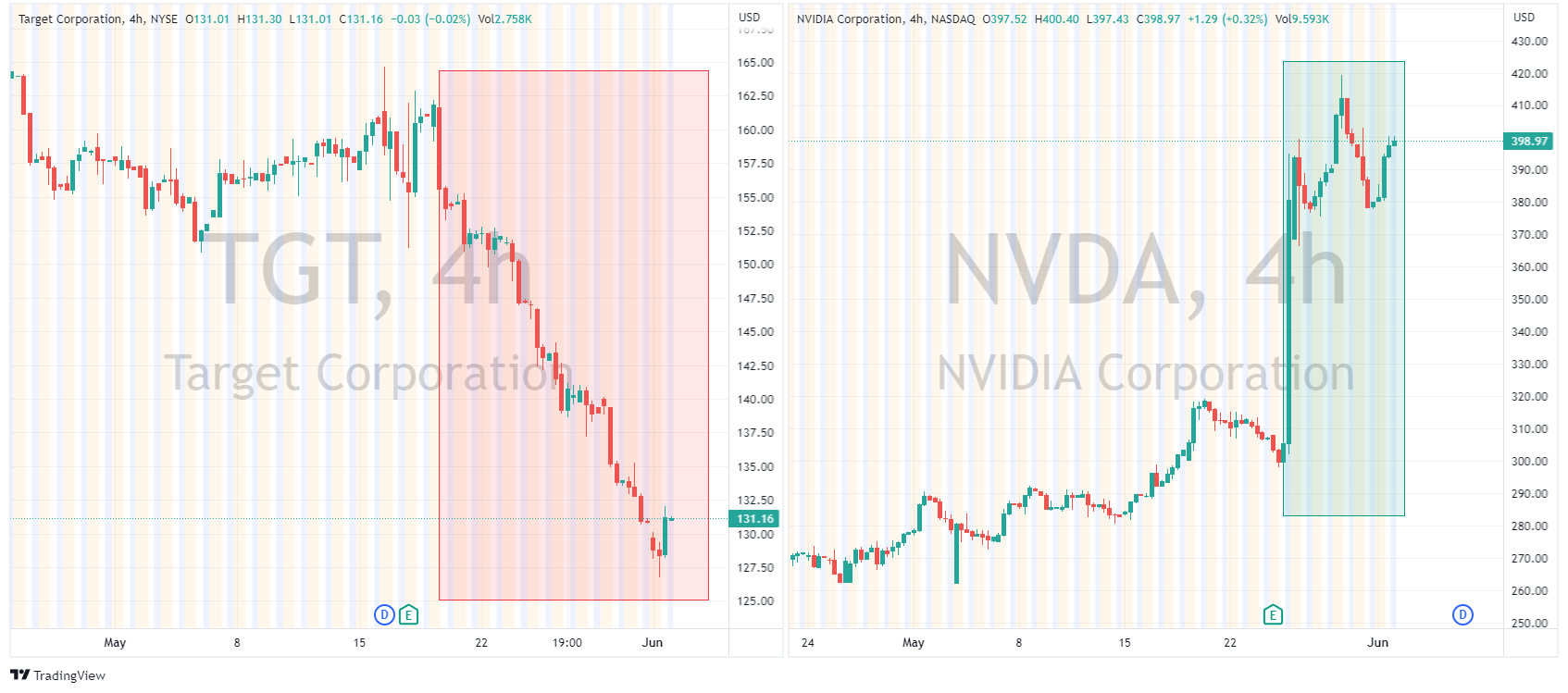

Two interesting US stocks to watch from the opposite ends of the performance spectrum are Target (TGT) and Nvidia (NVDA). Nvidia continued to push higher, soaring over 5% on Thursday on an AI mania that feels a bit like the Dot Com boom of 2000, whether it will end in the same way or not remains to be seen. At the other end we have Target which eked out a small gain to break a 10 day losing streak, it’s worst run since 2000 after a consumer boycott in the US, also not helped by a JP Morgan downgrade this week.

FX markets

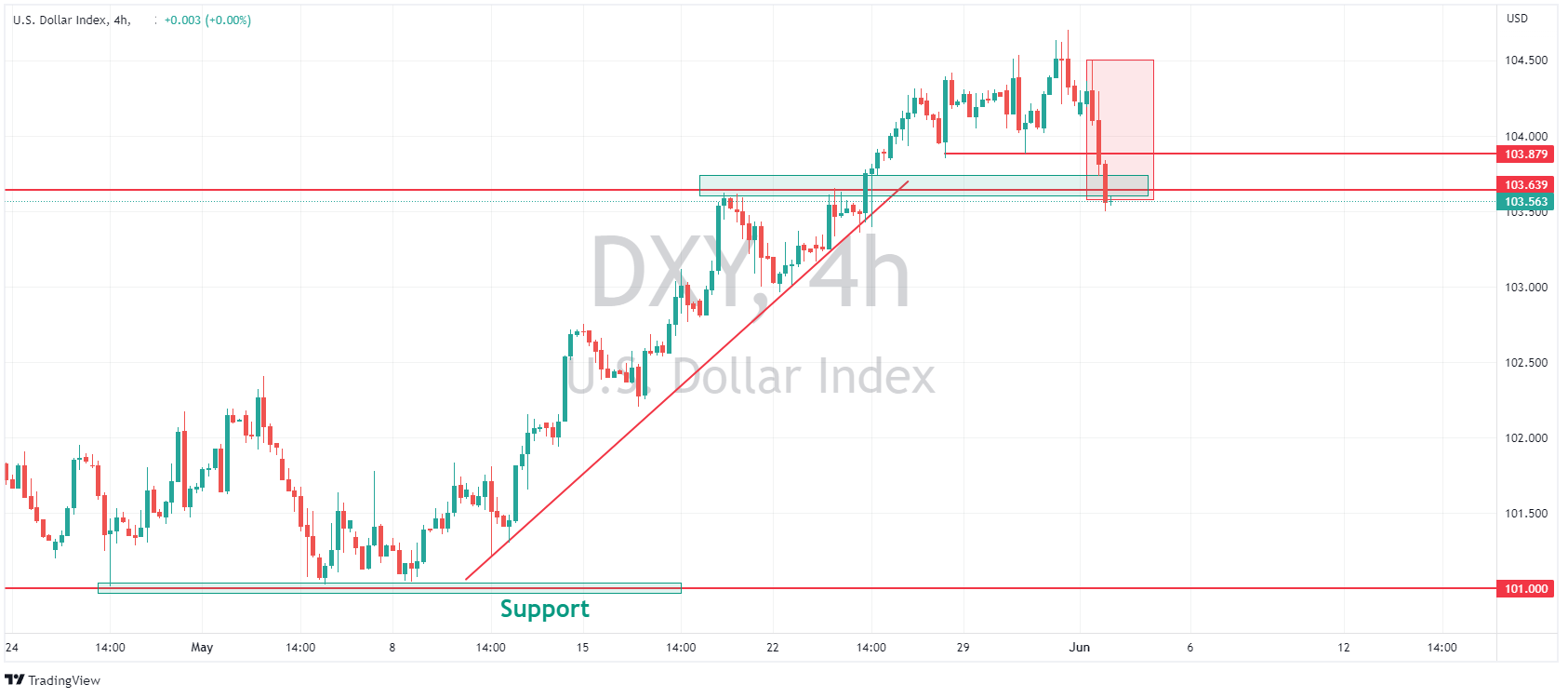

USD was lower on Thursday, printing a new weekly trough of 103.490 as the US dollar Index continued to slip at the tail-end of the US session as sentiment improved and yields slid on rate hike odds from the Fed re-pricing. DXY having its worst day since January and breaking the minor support at 103.64

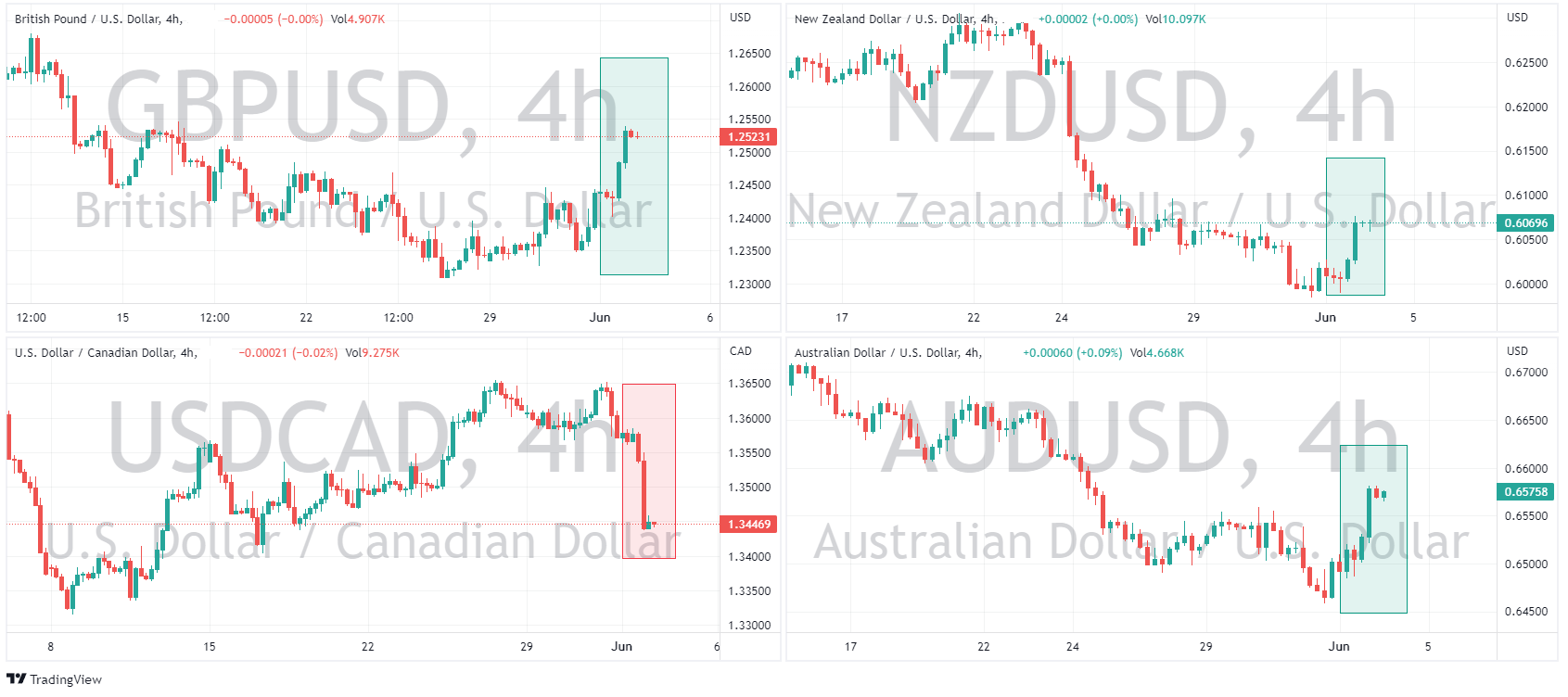

Cyclical currencies (AUD, CAD, NZD, GBP) were all firmer to varying degrees on account of risk-on sentiment and broad Dollar weakness. GBP saw strength to see Cable top 1.2500 to highs of 1.2539, while USDCAD hit a low of 1.3437 with gains crude oil supporting the Loonie. AUDUSD was the G10 outperformer to see the cross top out at 0.6581, helped by tailwinds from firmer commodities.

Commodities

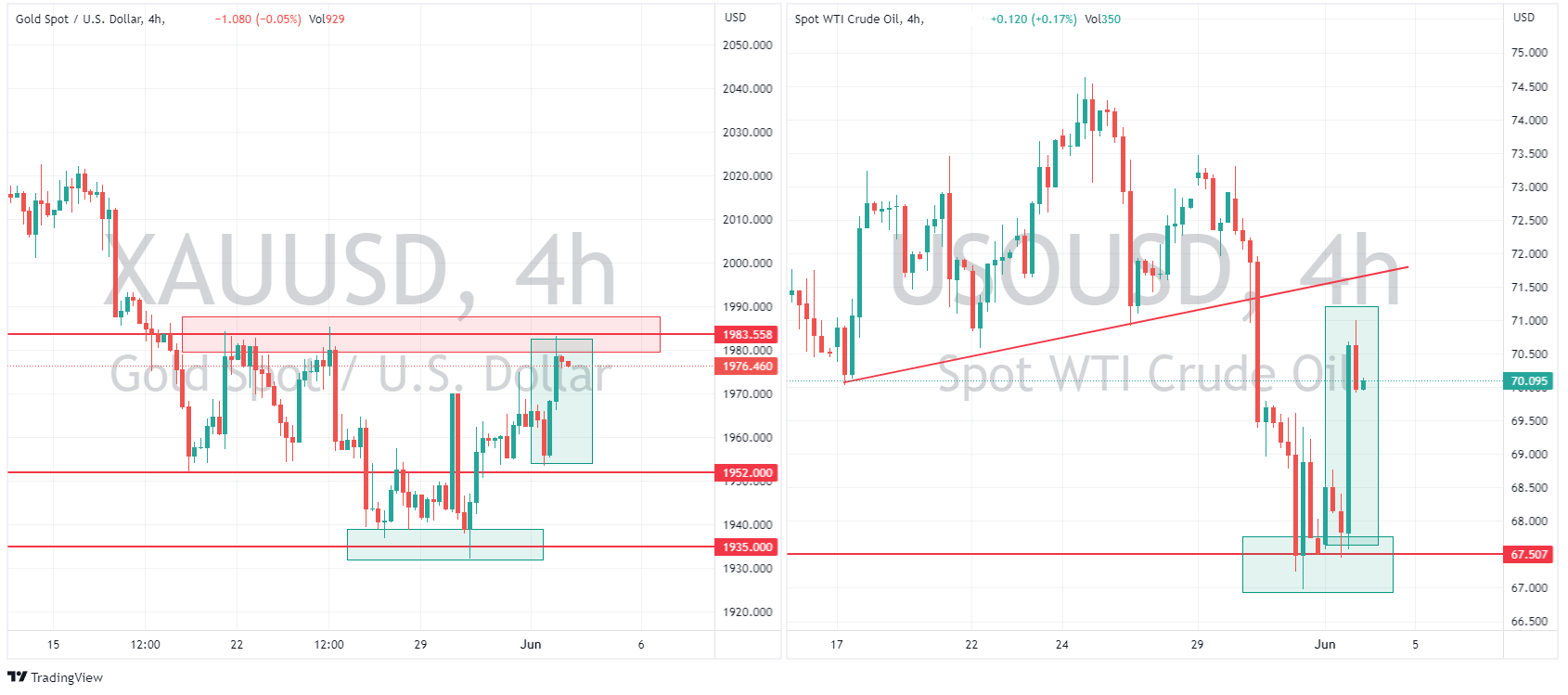

Crude oil soared on Thursday with the passing of the debt ceiling bill lifting risk sentiment and a weaker USD. Reuters sources also reported that OPEC+ is unlikely to deepen output cuts at June 4th meeting. Gold also rallied on a weaker USD and lower bond yields, XAUUSD moving back into its range and testing the resistance zone at 1983 USD an ounce.

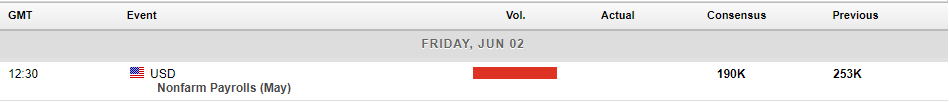

In scheduled economic announcements, the big one is Non-farm payrolls released in the US later today. Thursdays ADP jobs data showed some resilience in the US labor market but this will be the figure traders will be watching to make their bets on what the Fed will do at their June meeting, should be interesting.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

The trading week ahead – Central banks back in action RBA, BoC

Debt ceiling issues finally being put to rest last week saw a broad rally in US and global, with a big move up on Friday seeing the S&P 500 have its best week since March and hit it’s highest level since August last year. With Asian and US futures pointing to positive start to the week the risk on narrative seems to be continuing and w...

Previous Article

Hot CPI fails to hold AUDUSD above key level

Australian CPI released today surprised to the upside coming in at 6.8% y/y , well above the consensus of 6.4% which itself was an increase on March...